Education

Educational assistance is available through the following:

- Tuition Concession: This benefit provides financial support to faculty and staff, dependent children, and spouses pursuing degree programs.

- NC 529 College Savings Plan: This plan enables participants to choose one or more investment options, offering tax benefits for college savings.

- Student Debt Counseling Program: Fiducius provides assistance to faculty and staff in understanding their eligibility for programs that could reduce their student debt and/or refinancing option to consolidate their student debt and/or lower interest rates to pay the debt off sooner.

Tuition Concession

Faculty and Staff

At Wake Forest: The University pays full tuition for up to two courses per semester for either:

undergraduate* study, or study in the Graduate School of Arts and Sciences.**

At Other Institutions: $5,526.62 ($2,763.31 per semester) for undergraduate* tuition and academic fees.

Dependent Children

At Wake Forest: The University pays 94% for undergraduate* tuition and academic fees if hired before January 1, 2014, and 80% for undergraduate tuition and academic fees if hired on/after January 1, 2014.

At Other Institutions (FY2023): $12,086 ($6,043 per semester) for undergraduate* tuition and academic fees.

Spouses

At Wake Forest: The University pays 50% of the cost for undergraduate study, or study in the Graduate School of Arts and Sciences.** After 10 years of employment, Wake Forest will pay 66 2/3% of the cost.

At Other Institutions: N/A

*Applies if the individual does not hold an undergraduate degree.

**Graduate coursework is taxable.

Eligibility

Faculty and Staff

After completing two years of full-time service.

Dependent Children

Dependents are eligible if the faculty or staff member has either:

- Five years* of full-time continuous service if hired on/after January 1, 2014.

- Three years of full-time continuous service, if hired before January 1, 2014.

*If you worked at an accredited higher education institution at least two years immediately preceding employment at Wake Forest University, you may be eligible to reduce the waiting period to three years

Spouses

The benefit is available upon the faculty or staff member’s hire date.

Enrolling or Making Changes

All requests should be submitted through WIN, under the WF@Work tab.

NC 529 College Savings Plan

The North Carolina National College Savings Plan enables you to set aside money for qualified higher education expenses at Wake Forest University or other institutions. These expenses include:

- Tuition and fees

- Room and board

- Books, supplies, and equipment required for enrollment

You may open an account for yourself or a person of any age, including a newborn. Other relatives, friends, and certain organizations also may open an account and save for an individual’s college education.

Investment Options

A variety of investments cover a range of strategies, from conservative to aggressive. Select a mix to meet your objectives, time remaining until college, and risk tolerance.

Tax Advantages

As a North Carolina taxpayer, you may qualify for a tax deduction for contributions; there are no federal or state taxes on earnings.

Enrolling or Making Changes

- Follow the instructions on the How to Establish a 529 Plan document. There is a low minimum opening contribution required, and you may make additional monthly or occasional contributions.

- Send Human Resources a copy of the forms you are prompted to complete so a payroll deduction can be established.

- Adjust your current investment mix once each calendar year, if desired, or if the beneficiary of your account changes. You may update how your future contributions will be invested at any time.

Student Debt Counseling Program

Fiducius helps you navigate and determine your best option, including forgiveness and refinancing, based on your specific situation. As a faculty or staff member of Wake Forest University, you are eligible for this benefit if you have student loans for yourself or loans you’ve taken out for children or even grandchildren. Your spouse and other family members are also eligible to take advantage of this money-saving benefit for their own student loans.

Determine your eligibility, learn your potential savings and schedule time to talk with an Advisor about your next steps. Visit this site to get started.

Fiducius provides all education and individualized plans at no cost to you. Should you choose to enroll in one of their services, fees may apply. Fiducius will review this during your scheduled discussion with one of their advisors.

Resources

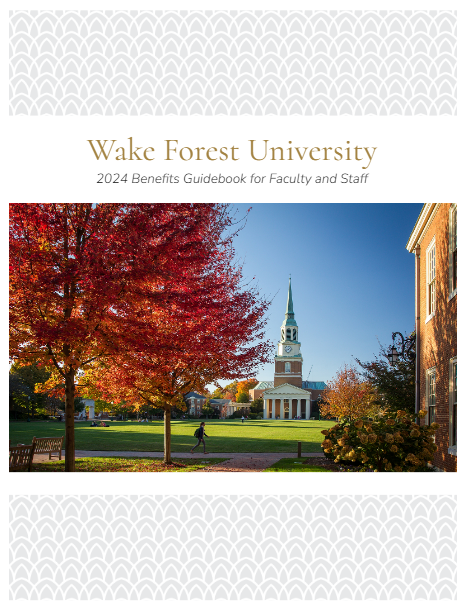

2024 Benefits Guidebook

The 2024 Benefits Guidebook for Faculty and Staff outlines benefits specific to the Jan. 1 through Dec. 31, 2024 plan year. The information included in the guidebook is intended as a benefit summary only.

Wake Forest University Human Resources

P.O. Box 7424, Winston-Salem, NC 27109

askHR@wfu.edu | P 336.758.4700 | F 336.758.6127